Bakit marami ang gusto ng long term healthcare?

Ang long term healthcare ay 3-in-1 solution na pre-paid, consumable healthcare. Pre-paid kasi bayad lang ng 7 years, consumable kasi pwedeng gamitin hanggang hindi na-co-consume ang value.

Three-in-one kasi

- ito ay life insurance to "Protect the family if you die too too soon"

- Ito ay healthcare to "Protect your health if you get sick."

- Ito ay investment to "Protect your future if you live long"

You should consider your healthcare and protection as a priority. Why? Even if you save a few hundred pesos a month, but no healthcare and life insurance, it will not take you far. When you get sick, disabled, or die suddenly, your savings won’t last very long. Getting long-term healthcare and life insurance are the best investments.

Bakit Kaiser?

Noong 2019, ₱171.5 BILLION ANG NAGASTOS SA HEALTHCARE NG MGA SENIOR CITIZENS

- ₱ 101.2 billion by seniors and families

- ₱ 32.5 billion by social health insurance scheme (or PhilHealth)

- ₱16.3 billion by revenue-based or central government scheme

- ₱21.5 billion by other financing, e.g., HMOs, etc.

Sino ang gusto mo magbayad ng iyong healthcare pag 60+ years old ka na?

Ikaw, galing sa pension mo?

Mga anak mo, galing sa pinagkakasyang sweldo nila?

Mas maganda kung ang long term healthcare mo, galing sa sariling health fund!

Kinuha mo habang ikaw ay young at healthy

para magamit kapag kapap old at sickly

LONG-TERM HEALTHCARE

This is the answer to your

healthcare needs when you

retire or get old. How

comfortable your health care

situation will be after you turn

age 60 depends on the

decision you make today.

INCOME

PROTECTION

This will protect your family

if you die too soon. Life

insurance protection can help

you replace your income,

help finance your

children's education,

pay estate tax, pay debts,

etc. instantly.

INVESTMENT

This is the answer if you

live too long.

This will generate

continuing income for you

when you retire.

It is your money working for you.

Nag-claim na Beneficiaries

Received P405,000

Isang beses palang nagbayad ng halagang P2,647. Sa hindi inaasahang pangyayari ay naka aksidente dahilan ng kanyang pagkamatay.

Received P450,000

OFW ang kanyang anak sa Israel. Nagkasakit at namatay sa Pilipinas.

Received P900,000

OFW sa Israel. Aksidenteng nahulog at naging sanhi ng kanyang pagkamatay.

Mga Benepisyo

TRANSFERABLE

Kung namatay ang planholder lahat ng benefits ay matra-transfer sa primary beneficiary during and after paying period.

RETIREMENT SAVINGS

Kumpletong package na ito kapag ikaw ay nagretiro. May Savings ka na, Health Insurance at Investment pang kasama.

ONLINE ACCESS

Hassle free na. Dahil lahat ay maa-access mo sa sarili mong portal or account. Maging sa pagbabayad.

A Complete Financial Solution

If You Get Sick,

If You Die Too Soon or

If You Live Too Long!

Benepisyo Habang Nagbabayad

- FREE Annual Physical Exam sa Kaiser Medical Center or accredited clinic at ospital sa inyong lugar.

- FREE dental cleaning (oral prophylaxis) once a year

- FREE dental benefits

- Minimum 50,000 pesos a year magagamit sa ospital depende sa plan na kinuha.

- P202,500 pesos minimum TERM LIFE INSURANCE

- 202,500 pesos minimum ACCIDENTAL DEATH BENEFITS

Mga Benepisyo sa Kaiser

- Healthcare Benefits

- Healthcare Savings Plan

- Term Life Insurance

- Accidental Death Benefits

- Disability Benefits

Benepisyo Matapos Mabayaran

- Pre-existing illness ay covered na kahit malala pa.

- Term Life and Accidental benefits ay tuloy-tuloy hanggang maturity.

- May 10% yearly healthcare hospital benefits limit ka depende sa plan na kinuha mo plus 10% compounding interest based sa fund.

- Any related to Maternity ay covered.

- May additional 3% yearly healthcare benefit din subject for provisions depende sa takbo ng market.

Options mo Pag Nag-Mature Na

3 Settlement Options Mo

- Ayaw mo i-withdraw para tuloy-tuloy ang benepisyo sa healthcare at tubo ng pera mo.

- Kalahati lang i-withdraw mo at ang natira ay para may healthcare benefit ka pa rin at ang natirang pondo ay patuloy na tumutubo.

- Withdraw all the amount. Sa option na ito, lahat ng benefits mo ay wala na.

Long Term Care Bonus

85%

ng binayad mo ay babalik sayo pagdating ng maturity once hindi mo nagamit during paying period.

P411,750 (Plan K-100) = P350,000 (85%)

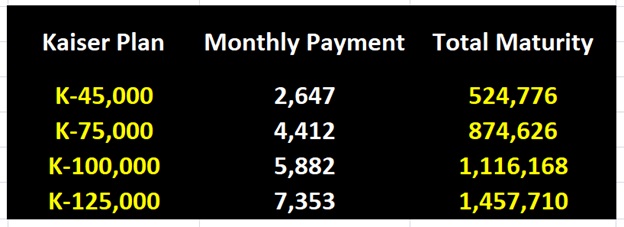

| Kaiser Plan | Total Maturity |

|---|---|

| K-45,000 | P524,776 |

| K-75,000 | P874,626 |

| K-100,000 | P1,116,168 |

| K-125,000 | P1,457,710 |

Pag malaki plan mo, malaki ang benepisyo na matatanggap at makukuha mo

Dynamic Lined Invest Sticker Total Amount on Maturity

Pag malaki plan mo, malaki ang benepisyo na matatanggap at makukuha mo

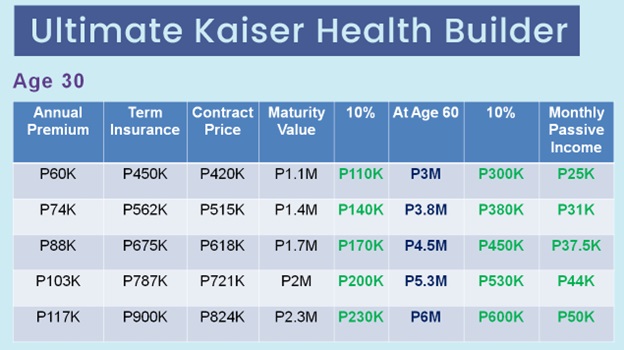

Sample Kaiser Plan and Computation

Sample:

- At Age 40:

Kaiser Plan K-100

Monthly: P5,882

Yearly: P58,821

Total Contract Price: P411,750 - At Age 47: Fully Paid

- At Age 60: Kaiser Mature

- Total Maturity Amount P1,166,168

Contract Provisions

- 1-7 years = Paying period or Accumulation period

- 8-20 years = Waiting period or Extended Period

- 20 years = Maturity or Long-Term Care Period

- 7 years to pay + 13 years to wait = 20 years

Retirement Savings

Kumpletong package na ito kapag ikaw ay nagretiro. May savings ka na, Health Insurance at may Investment pang kasama.

FREE Financial Coaching

Kausapin si Coach!

Gumawa ng personal na plano para sa kinabukasan ng pamilya.