Comparing HMO plans

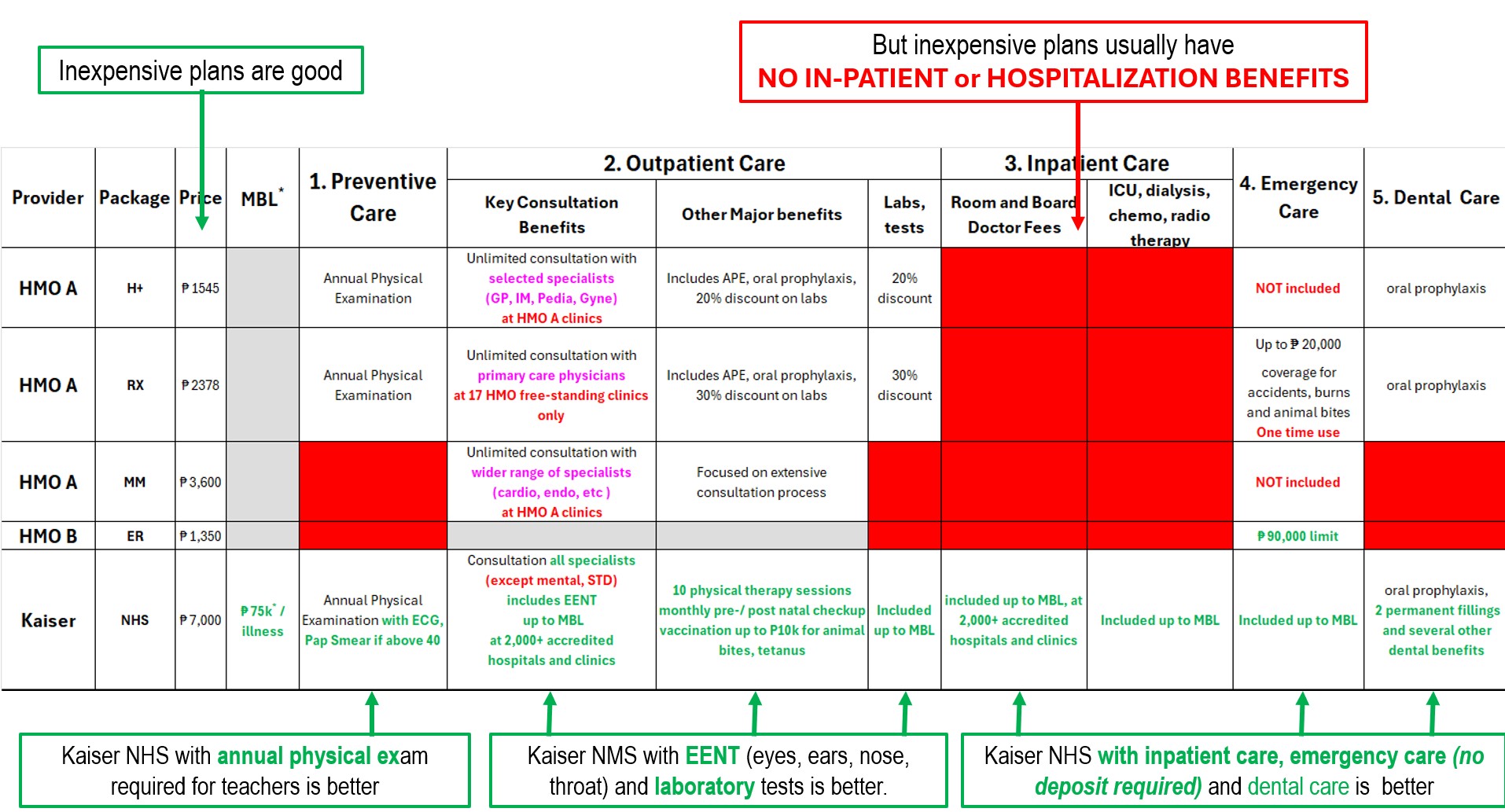

NOT all HMO plans are created equal. Inexpensive plans usually have limited benefits. Budget permitting, comprehensive plans are best.

Procedures

Formal Group Informal Group Dependents Paper Transmittal Email Transmittal Payment Accredited HospitalsDownloads

NHS at a Glance Principal Step-by-Step Guide HMO Plans ComparisonNOT all HMO plans are created equal

-

Many inexpensive plans have fewer benefits

- Some have limited benefit classes (e.g. consultation only, emergency care only, etc)

- Some have no “standard” inclusions, e.g. no annual physical examination

- Most inexpensive plans do not have in-patient and emergency benefits

- Many gray areas

-

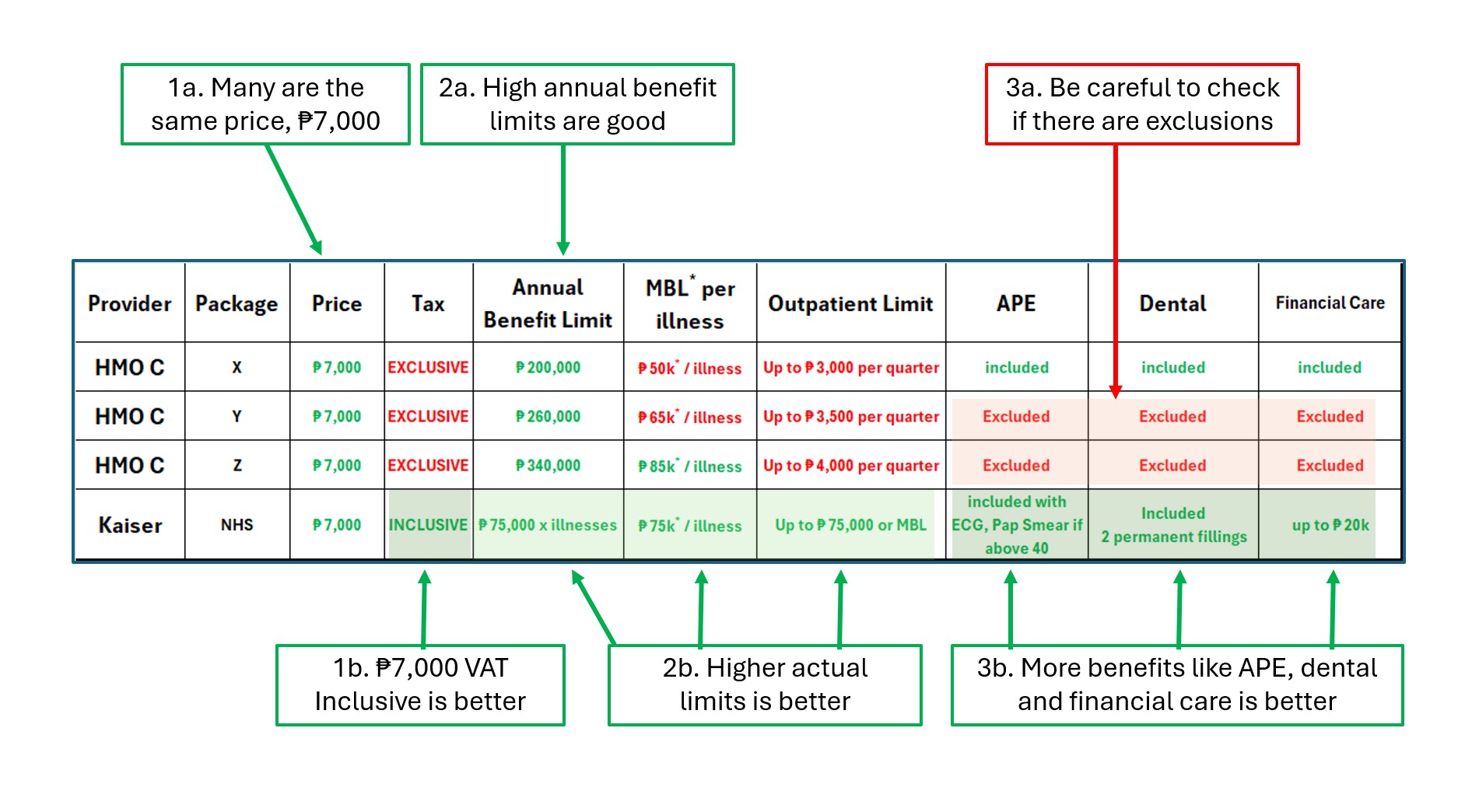

Some group plans highlight low price and high limits

- Some have hidden costs, e.g plus 12% VAT

- Some have “high” total limits but lower itemized limits (e.g. P4k per quarter for outpatient care)

- Some have unexpected exclusions

-

Kaiser NHS

- Comprehensive healthcare ( 5-point healthcare benefits plus financial care)

- NO DEPOSIT on admission

- Covers pre-existing illnesses

- High benefit limits

Kaiser International HealthGroup

Your 1st Name in Healthcare

National HealthCare Shield

- ₱ 7k premium

- ₱ 75k* Maximum benefit limit per illness

Lower limit for less than 500 members - Eligibility age 18 - 65 years old

- Covers pre-existing diseases

- Includes Annual Physical Examination

- Preventive Healthcare

- Outpatient Card

- Inpatient Care

- Emergency Care

- Dental Card

- Includes Financial Assistance (in case of death, dismemberment)

- Includes Pre- / Post-natal checkup

- Includes Physical Therapy

- Includes vaccination for animal bites

Hello